March 10, 2014

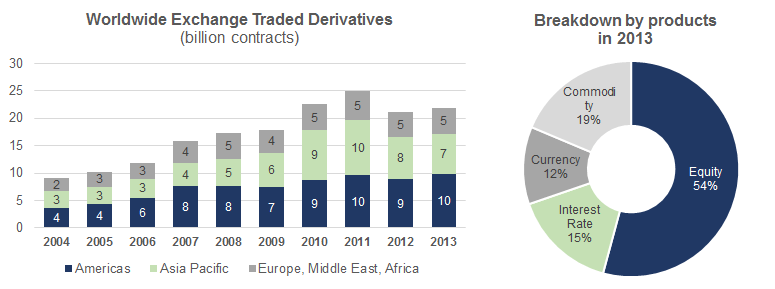

In 2013, the number of Exchange Traded Derivatives (ETD) worldwide increased by 3% to 22 billion contracts, according to statistics compiled by the World Federation of Exchanges (WFE).

The WFE, which annually conducts a survey on derivative markets, found that in 2013, 22 billion derivative contracts (12 billion futures and 10 billion options) were traded on exchanges worldwide – a 685 million increase above derivatives contracts traded in 2012. The complete WFE analysis of global derivatives markets will be available in May 2013.

Source: World Federation of Exchanges

Other highlights of the preliminary WFE derivatives report regarding exchange traded derivatives (ETD):

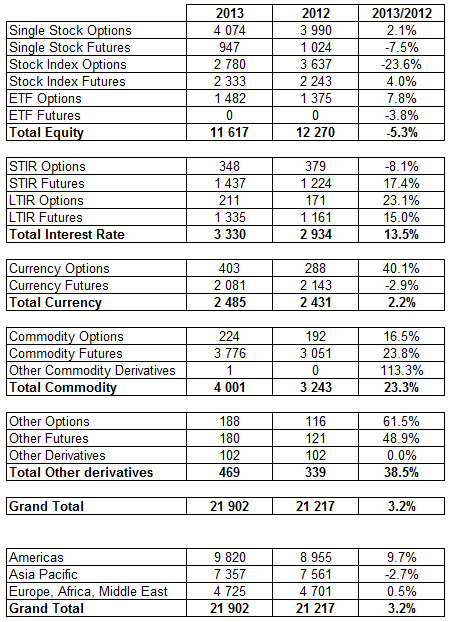

Equity derivatives: The drop in equity derivatives (-5.3%) is mainly explained by the size changing of the KRX (Korea Exchange) KOSPI 200 contracts, the weight of which is very significant. The overall 2013 equity derivatives volume increased by 3.2% when those contracts are excluded from the statistics.

Interest rate derivatives: The volume of Interest Rate options and futures traded increased significantly (+13%) after the sharp decline observed in 2012 (-15%). Both Short Term and Long Term segments experienced vivid growth. Currency derivatives: Currency derivatives increased in volume by 2.2% in 2013.

Commodity derivatives: Commodity derivatives (+23%) saw the greatest increase in volume in 2013, largely as a result of two major factors: 1.) the transfer of cleared OTC energy swaps to futures in the United States by the InterContinental Exchange (ICE) in 2012 in anticipation of the final Dodd-Frank regulatory requirements, and 2.) the continuing sharp increase in volume at Mainland Chinese Exchanges (+40%). The United States and Mainland China accounted for 79% of the global volumes in 2013.

Other derivatives: The "other derivatives" category comprises a wide range of products including Volatility Index options, Exotic options and futures, REIT derivatives, Dividend and Dividend Index derivatives or CFDs. Volumes in this category increased sharply (+38.5%) in 2013, highlighting the ongoing innovation in derivatives offered by Exchanges.

Source: World Federation of Exchanges

Excluding Kospi 200 options, the highest increase in exchange traded derivatives volume in 2013 was observed in Asia Pacific region (+13.2%), followed by Americas (+9.7%) and Europe, Africa, and Middle East (+0.5%).

Tags:

For more information, please contact:

- Cally Billimore

- Manager, Communications

- Email: [email protected]

Phone: +44 7391 204 007 - Twitter: @TheWFE